When we think of celebrities like Whoopi Goldberg, we often picture a life free from financial concerns—lavish lifestyles, extravagant vacations, and enough money to last a lifetime. But Goldberg’s recent admission that she can’t afford to retire has left many people scratching their heads. Despite reportedly earning millions annually, the actress and talk show host revealed that financial security remains a concern for her, shedding light on a reality that resonates with Americans across income levels.

Her candid revelation highlights a critical point: even high earners face financial pressures in today’s challenging economy. Let’s dive into Goldberg’s story to understand the complexities behind wealth, responsibilities, and the true cost of living.

Whoopi Goldberg Opens Up About Retirement Struggles

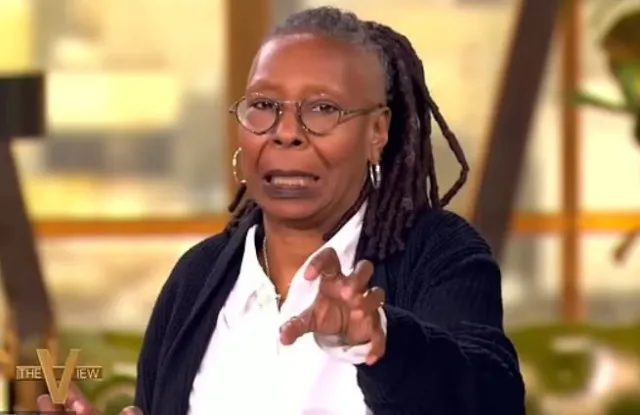

During a November 12 episode of The View, Goldberg made a startling statement about retirement. She admitted, “If I had all the money in the world, I would not be here.” This candid remark surprised viewers, given her reported $5–$6 million annual earnings. For many, it seemed incomprehensible that someone with her income would feel financially constrained.

Goldberg elaborated that her financial obligations extend beyond her personal needs. As the cornerstone of her family’s financial support, she shoulders responsibilities that go beyond typical household expenses. Her situation underscores a universal truth: financial well-being isn’t determined by income alone but by a combination of factors, including expenses, commitments, and future planning.

The Hidden Financial Pressures on High Earners

At first glance, it’s hard to reconcile the idea of financial strain with someone earning millions. However, Goldberg’s story serves as a reminder that income doesn’t exist in a vacuum. Even the wealthiest individuals face financial obligations that can chip away at their earnings.

Goldberg explained that her family relies on her income, including her great-granddaughter. This level of responsibility, combined with the ever-increasing cost of living, adds significant pressure. For many, her story echoes a relatable truth: no matter how much you earn, rising expenses and obligations can make it feel like your income is never enough.

The Rising Cost of Living: A Shared Struggle

One reason Goldberg’s story resonates with so many is the shared experience of coping with soaring living costs. From housing and healthcare to food and education, financial demands are growing for everyone. Goldberg acknowledged this during her View appearance, saying, “I appreciate that people are having a hard time. Me too. I work for a living.”

Her honesty struck a chord with viewers who face similar pressures on a smaller scale. While her income may be higher, her acknowledgment of these struggles builds a bridge of understanding. Financial stress, after all, is universal—whether you’re budgeting for groceries or navigating multimillion-dollar responsibilities.

Whoopi Goldberg’s Critique of Economic Inequities

Goldberg hasn’t shied away from sharing her frustrations with the broader economic system. She recently criticized grocery store owners, accusing them of exploiting consumers. “Your grocery bills are what they are because the folks that own the groceries are pigs,” she boldly declared. This blunt statement reflects her belief that corporate greed is a driving factor behind rising food prices.

Her remarks resonated with those who feel the weight of inflation in their day-to-day lives. However, they also drew criticism from others who believe the issue is more complex. Regardless, Goldberg’s critique shines a spotlight on the frustration many feel about the disconnect between wages and the cost of living.

The Emotional Toll of Financial Pressure

Beyond the numbers, financial stress takes an emotional toll, even on those who appear to have it all. Goldberg’s open discussion about her financial worries shows a vulnerable side of celebrity life that’s often hidden from public view.

For Goldberg, the pressure to continue working stems not just from financial obligations but also from a desire to provide stability for her family. This sentiment is familiar to many Americans who feel the constant push to keep earning, whether to support loved ones or to secure their future.

A Broader Perspective: Financial Security Across Income Levels

Goldberg’s story raises an important question: what does financial security really mean? For many, the assumption is that a higher income automatically guarantees peace of mind. But her experience tells a different story. Financial security is about more than just earning power—it’s about balancing income with expenses, planning for the future, and managing responsibilities.

Goldberg’s admission challenges the misconception that wealth eliminates financial worries. In reality, higher earnings often come with higher expectations and obligations, creating a different set of financial challenges.

Lessons from Whoopi Goldberg’s Story

Goldberg’s openness offers valuable takeaways for anyone navigating financial stress:

- Income Isn’t Everything: Regardless of how much you earn, financial obligations can quickly erode a sense of security.

- Family Comes First: Like many, Goldberg prioritizes her family’s needs, even when it means putting her own retirement plans on hold.

- Living Costs Are Universal: From celebrities to everyday Americans, rising expenses impact everyone. Housing, healthcare, and food costs continue to outpace earnings, making financial planning more critical than ever.

Conclusion: A Celebrity’s Struggles Reflect a Universal Truth

Whoopi Goldberg’s admission that she can’t afford to retire may have surprised fans, but it underscores a broader reality about financial pressures in today’s economy. Her story highlights how even those with significant incomes can feel the weight of rising costs, family obligations, and long-term planning.

Goldberg’s honesty offers a refreshing perspective on celebrity life, reminding us that fame and fortune don’t guarantee financial freedom. Instead, her experience serves as a powerful reminder that financial security is about more than just income—it’s about balance, priorities, and planning for the future.

For viewers, her candid remarks offer a chance to reflect on their own financial situations and find solidarity in the shared challenges of making ends meet. Whether you’re managing millions or a modest paycheck, Goldberg’s story is a reminder that financial struggles are more universal than we might think.