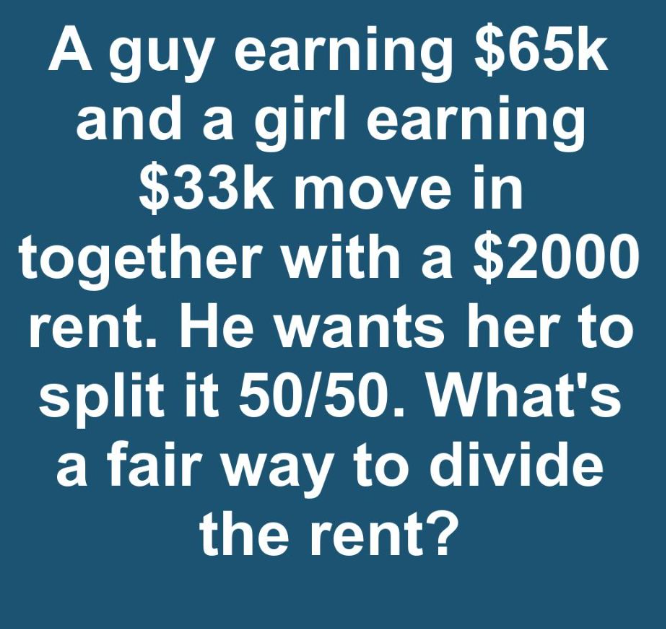

Moving in together is an exciting milestone in any relationship, but it also comes with financial considerations. One of the most common challenges is deciding how to split rent fairly when there’s a significant income gap between partners. Should rent be divided equally, or should contributions be based on earnings?

In this scenario, one partner earns $65,000 annually, while the other makes $33,000. Their shared rent is $2,000 per month. A 50/50 split may seem logical, but is it fair? Let’s explore different ways to distribute rent expenses equitably.

Understanding Income Disparities in Relationships

Couples often have different earning levels due to various factors like career paths, education, and experience. Ignoring these differences and opting for an equal split might lead to financial strain on the lower-earning partner. The key to a fair arrangement lies in assessing each person’s financial situation, including income, debts, and other obligations.

Below are three common approaches couples use to split rent when incomes differ significantly.

Video: 10 Couples Confess How They Split Rent And Bills

Method 1: Proportional Rent Split Based on Income

One of the fairest methods is to divide rent based on the proportion of total household income each person contributes.

- Total Household Income: $65,000 + $33,000 = $98,000

- Percentage of Total Income:

- Higher earner: 66% ($65,000 / $98,000)

- Lower earner: 34% ($33,000 / $98,000)

- Rent Contribution:

- Higher earner: $1,320 (66% of $2,000)

- Lower earner: $680 (34% of $2,000)

This method ensures both partners contribute fairly based on their financial capabilities. It helps maintain financial balance while preventing undue hardship on the lower earner.

Method 2: Flat Percentage of Income Contribution

Another option is for each partner to allocate the same percentage of their income toward rent. A common standard is 30% of income toward housing.

- Higher earner’s rent share:

- $65,000 × 30% ÷ 12 months = $1,625 per month

- Lower earner’s rent share:

- $33,000 × 30% ÷ 12 months = $825 per month

This method ensures that each partner contributes an amount they can afford without overextending their budget.

Method 3: Splitting Other Household Expenses Instead of Rent

If a couple prefers a 50/50 rent split but recognizes the financial imbalance, they can compensate in other ways. The lower-earning partner can contribute less to other shared expenses like:

- Groceries

- Utilities

- Streaming services

- Household supplies

For example, if both partners split rent at $1,000 each, the lower earner could cover more non-rent expenses to even out financial contributions. This approach works well if both partners are comfortable with the arrangement and view it as fair.

The Importance of Open Communication About Finances

Money conversations can be uncomfortable, but they are essential for a successful living arrangement. Couples should discuss:

- Income and financial obligations

- Comfort levels with different rent-splitting methods

- Other expenses beyond rent

- Long-term financial goals

A proactive conversation about finances ensures transparency and prevents resentment from building up over time.

Beyond Rent: Other Shared Financial Responsibilities

Rent is just one part of the financial equation when living together. Other costs can include:

- Utilities (electricity, water, internet)

- Groceries

- Transportation

- Dining out & entertainment

- Savings for future goals

By factoring in all household expenses, couples can create a more holistic approach to financial fairness.

The Impact of Financial Stress on Relationships

Disagreements about money are one of the top reasons couples argue. If one partner feels overburdened by financial responsibilities, resentment can build. Conversely, if the higher earner feels they’re paying too much, they may feel taken advantage of.

The key to avoiding these issues is fairness, not necessarily equality. A good rent-splitting strategy ensures that both partners contribute in a way that aligns with their financial reality.

Legal Considerations for Cohabiting Couples

If an unmarried couple is sharing a lease, it’s a good idea to discuss legal protections, such as:

- Cohabitation agreements outlining financial responsibilities

- Joint accounts for shared expenses (if desired)

- Clear agreements on handling lease termination or relocation

Discussing these aspects in advance can prevent complications if circumstances change.

Conclusion: Finding the Right Balance in Rent Splitting

There is no one-size-fits-all approach to splitting rent fairly when incomes differ. The best method depends on the couple’s financial situation and mutual comfort level. Whether using proportional income, a percentage-based contribution, or balancing costs through other expenses, the goal is to ensure financial fairness while maintaining harmony in the relationship.

By prioritizing open communication, understanding each other’s financial realities, and working together, couples can build a living arrangement that supports both partners without creating unnecessary stress.